When we peel the curtain back, the unfamiliar starts to reveal itself.

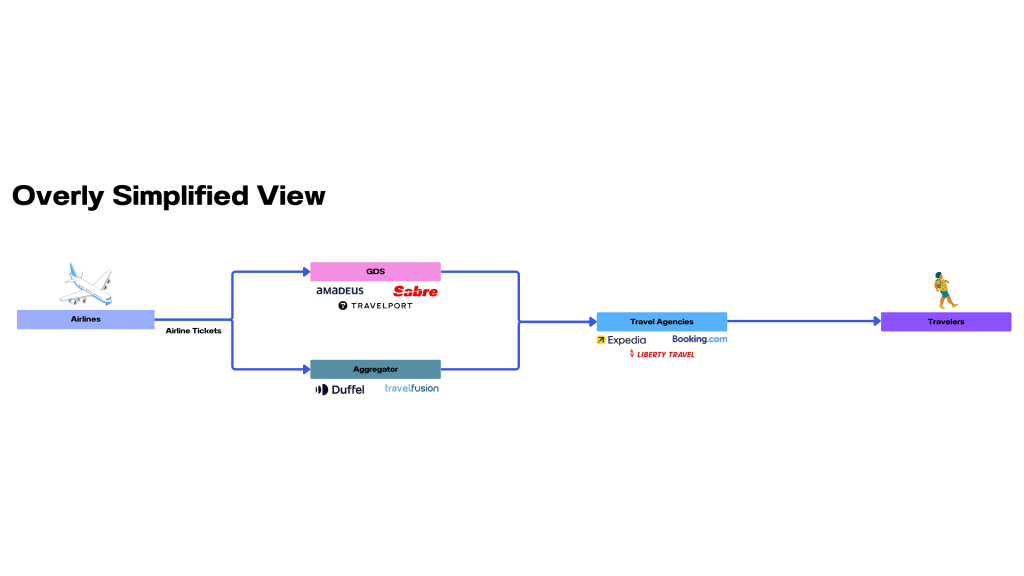

Let’s start with the distributors. Remember the online travel agencies and traditional travel agents we talked about earlier—the ones we see in front of the curtain? As it turns out, they don’t actually source airline tickets (inventory) themselves. Much like how a grocery store relies on a wholesaler to supply them with fresh fruit, these travel sellers depend on a middleman to access bookable inventory.

Those middlemen are the distributors.

Global Distribution Systems (GDS)

The original player in this space. GDS platforms like Amadeus, Sabre, and Travelport were built to connect airlines and hotels to travel agencies around the world. They use an old-school data format called EDIFACT, a messaging language that dates back to the early days of commercial computing.

The first GDS emerged in the 1960s, when Sabre was developed as a joint project between American Airlines and IBM. What began as a way to automate flight reservations quickly became the standard infrastructure for travel distribution—eventually expanding to include hotels, rental cars, and more.

For decades, GDSs held an iron grip on airline distribution. If you wanted to sell flights through an agency or online platform, you almost always went through a GDS. They were the default distributor—and for a long time, the only one.

But things have started to shift.

Aggregators: The “New GDS”

While traditional GDSs may not see them as direct replacements, a new category of distributors has emerged: aggregators. And to most travelers—and even many in the industry—they function much the same.

As airlines modernize their technology, they’re adopting new ways to distribute content—most notably through New Distribution Capability (NDC) and Direct Connect APIs. These allow airlines to deliver more customized, dynamic offers while bypassing some of the constraints of legacy infrastructure.

This shift gave rise to aggregators—companies built to collect this modern content from multiple airlines and deliver it to OTAs, travel agents, and corporate booking platforms. Names like Travelfusion and Duffel are leading this movement.

Sound familiar? That’s because, conceptually, aggregators are doing what GDSs have done for decades—just with newer tools, modern data standards, and greater flexibility.

What It All Means

The distribution landscape is changing. What used to be a one-lane highway is now a growing network of competing paths—each vying to shape the future of how travel content reaches the traveler.

While there are other types of distributors—such as consolidators, who negotiate discounted fares by committing to bulk ticketing, and consortium networks, which aggregate independent travel agents to negotiate favorable supplier rates—GDSs and aggregators remain the primary engines of travel distribution technology.

Leave a comment